Deep Dive: What We Can Learn from the 7% Decline in Consumer Spending

Image: @ New Frontier Data

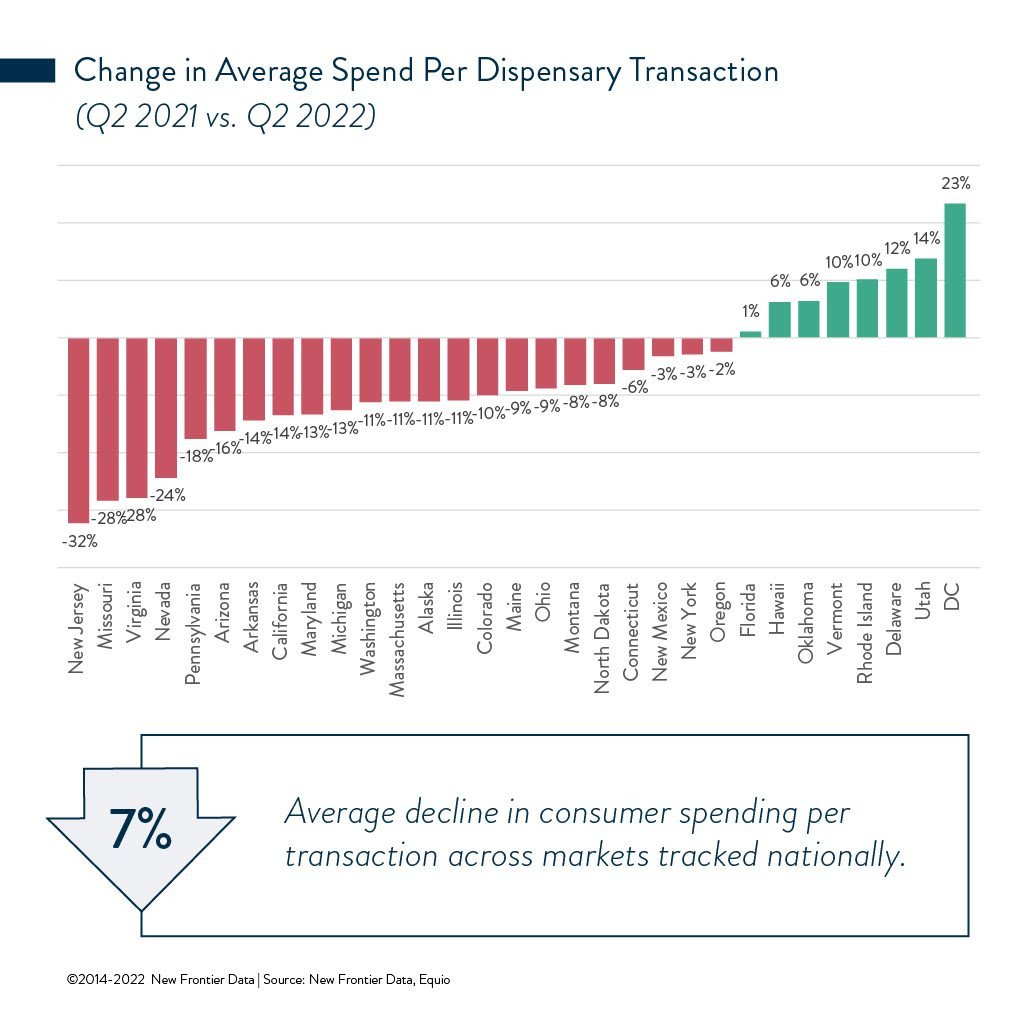

New Frontier Data recently outlined how cannabis customers have reducing their spending, to the tune of a 7% year over year decline.

MG Magazine anaylzed the findings, which are pertinent to anyone in the cannabis business.

Three points of emphasis are below:

1: A Difference In States

As one can tell in the above graph, the decline looks very different from state to state. The legacy markets of Colorado, Washington, California, and Oregon all align fairly closely to the 7% aggregrate decline, with Oregon seeing a 2% decline and California seeing a 14% decline. These legacy states may be the most accurate in terms of customer sentiment, as they are mature markets with fewer externalities.

New Jersey saw the most precipitous decline, perhaps due to neighboring New York City's burgeoning cannabis market.

Washington DC had a large growth in customer spending, perhaps related to its unique cannabis gifting culture that surely feeds from its medical cannabis sales.

2: How Consumer Behavior Is Shifting The underlying factors that are driving this consumer behavior are somewhate obvious - inflation has raised the cost of day to day goods, and customers may be reducing their discretionary cannabis spend as a result. Consumers are also traveling and going out more, which means they are consuming less cannabis than they would in their own homes. Finally, consumers don't seem to have much brand loyalty or store loyalty, which makes them gravitate towards lower and lower prices offered by highly competitive stores and brands. While these factors are concerning in the short term, the inflation and travel trends should slowly eventually recede, which should bring back consumer cannabis spending. As strong brands continue to emerge, less switching should occur as well for consumers, which will preserve pricing. 3: The Takeaways for Cannabis Business

It's important for anyone in the cannabis space to understand why consumers are slowing down their cannabis spending.

Many in the business are responding to consumers' reduced purchasing power by increasing pricing promotions. This may have a short term postive effect, but could actually hurt in the long run.

The best long-run approach is to build brands that resonate with customers. In doing so, cannabis companies are creating value for consumers that goes beyond the cannabis itself.

Strong brands with strong followings will be much more resilient to shifting consumer purchasing habits in the future.

What does building a strong brand look like?

John Kagia, chief knowledge officer at New Frontier, has a great summary:

"The most successful brands and retailers are those that have an intimate understanding of who their customers are, what motivates their [cannabis] use, and animates their consumption behavior.”

---

The days of the initial green rush and the gravy train of lockdown cananbis spending may be in the rear view mirror for the cannabis industry. Thus, it is more important ever for cannabis companies to focus on the fundamentals, including cost control and brand building. While this will be a challenge in the short term, it is a crucial step towards the industry maturing, and the industry and consumers will all be in a better position in the long term.

Read More:

What We Can Learn from the 7% Decline in Consumer Spending [MG Magazine]